Professional: A person engaged or qualified in a profession.

A mortgage professional is someone who has the experience and local community contact that is necessary to help guide you through one of the biggest financial purchases and decisions of your entire life!

The big question here is what can a mortgage professional do for me as a homebuyer?

To begin, here are a few things you should consider:

Paperwork

A mortgage professional helps you with all paperwork and disclosures necessary in today’s heavily regulated financial environment

Experience- Mortgage professionals here at Northpoint are well educated in the mortgage business and are experienced with the entire home sale & purchase process

Negotiations

Mortgage professionals act as a “buffer” in negotiations with all parties throughout the transaction (buyer, seller, appraiser, inspector, closing attorney, etc.)

Pricing

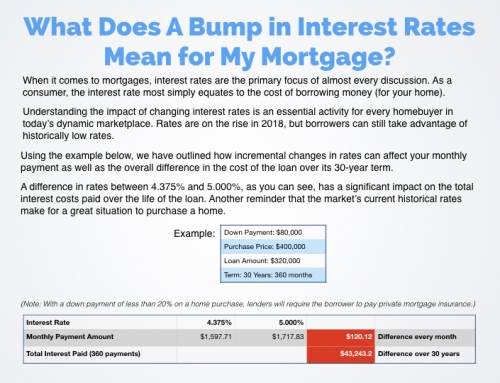

They help you understand financing options available to borrowers in the current marketplace

Understanding the Market

Not only do mortgage professionals help you see the financing side of your home purchase more clearly, but they also understand the economic markets behind the scenes that directly impact your mortgage!

From down payment options to mortgage insurance and interest rates, a mortgage professional has all of the above and more to offer you in terms of experience and advice that you can use to help you reach you homeownership goals!