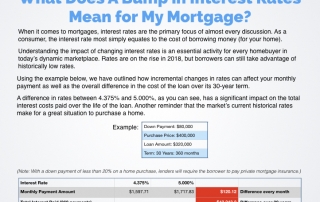

What Does a Bump in Rates Mean?

What does a bump in rates mean for my mortgage? Look no further. The answers are here!!! In today's rising rate environment, there is no better time than now to truly understand how changes in rates can affect your home-buying decision. Contact us today to see how we can help!